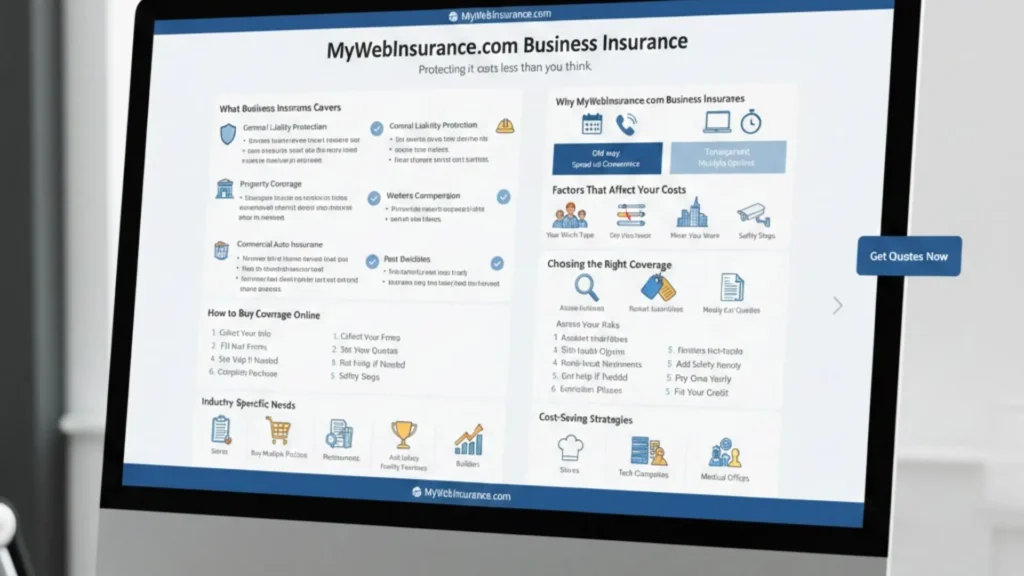

MyWebInsurance.com Business Insurance: Protect Your Business

Running a business costs money. Protecting it costs less than you think. One lawsuit can destroy years of hard work. Equipment breaks down. Employees get hurt. Customers file claims. Mywebinsurance.com business insurance helps you find coverage fast. This guide shows you what to buy and why it matters.

What Business Insurance Covers

Insurance pays when bad things happen. You choose what risks to cover. Different policies protect different problems.

General Liability Protection

This covers when you hurt someone or damage their stuff. A customer trips in your store. Your work breaks something at a client’s office. Someone sues you for using their photo. The policy pays:

- Legal defense costs

- Medical expenses for injured parties

- Property damage settlements

- Advertising injury claims

Small shops need this. Big companies need this. Everyone needs this policy first.

Professional Liability Insurance

You give advice. You provide services. Sometimes things go wrong. A client loses money because of your work. They sue you for the loss.This pays for:

- Errors in professional services

- Omissions that harm clients

- Missed deadlines

- Contract problems

Lawyers need it. Accountants need it. Consultants need it. Any expert who gives advice needs this.

Property Coverage

Your building has value. Your equipment costs money. And inventory fills shelves. Fire destroys it. Thieves steal it. Storms damage it. This covers:

- Fire and smoke damage

- Stolen items

- Storm damage

- Broken equipment

Add up what you own. Buy enough to replace everything.

Workers’ Compensation

Your employee gets hurt at work. They need a doctor and miss work. They need money for bills. The law says you must pay. This gives them:

- Doctor visits

- Medicine costs

- Lost wages

- Long-term care

Almost every state requires this. You need it if you have workers.

Commercial Auto Insurance

Your company uses vehicles. Trucks make deliveries. Vans carry equipment. Cars visit clients. Regular car insurance won’t work for business use. This protects:

- Car repairs

- Other drivers

- Medical bills

- Your drivers

Any business vehicle needs this coverage.

Why Mywebinsurance.com Business Insurance Matters

Old way: call ten agents. Wait for callbacks. Set up meetings. Drive to offices. Repeat for weeks. New way: visit one website. Answer questions once. See all prices. Compare coverage. Buy in minutes.

Speed and Convenience

Type in your details. Get quotes in minutes instead of days. Compare multiple carriers side by side. Review coverage details instantly. Purchase policies online without appointments.

Transparent Pricing

See real numbers. No hidden costs. No surprise fees. You know what you pay before buying.

Multiple Options

Ten companies compete for your business. You pick the best price. You choose the best coverage.

Factors That Affect Your Costs

Some businesses pay more. Some pay less. Here’s why prices change.

Your Work Type: Roofers pay more than writers. Dangerous work costs more to insure.

Company Size: More workers mean bigger bills. A higher sale means higher rates.

Where You Work: Cities with more crime cost more. Areas with floods or storms cost more.

Past Claims: Made claims before? Rates go up. No claims? Rates stay low.

How Much Coverage: Want more protection? Pay more money. Want basic coverage? Pay less.

Safety Steps: Cameras lower rates. Employee training lowers rates. Safety rules lower rates.

Choosing the Right Coverage

Buy too little and lose everything. Buy too much and waste money. Here’s how to get it right.

Assess Your Risks

What could go wrong tomorrow? List every problem. Think about your work. Think about your location. Write it all down.

Calculate Asset Values

Walk through your business. Count everything. Write down what it costs to replace. Not what you paid. What it costs now.

Review Legal Requirements

Your state makes rules. Some insurance is required by law. Workers’ comp tops that list. Check what you must buy.

Match Industry Standards

What do others in your field buy? Ask competitors. Check industry groups. Learn the standard amounts.

Consider Growth Plans

Planning to grow? Buy coverage that fits bigger plans. Adding coverage later costs more.

Common Coverage Mistakes

People make these errors. Don’t be one of them.

Buying Too Little: Prices go up every year. Your old coverage doesn’t cover new costs. Check values yearly.

Missing the Fine Print: Policies don’t cover everything. Read what’s NOT covered. Fill those gaps with extra policies.

Mixing Personal and Business: Your home insurance won’t cover business stuff. Your car insurance won’t cover work driving. Keep them separate.

Forgetting Cyber Protection: Hackers steal data. Viruses shut down computers. Regular insurance won’t help. Buy cyber coverage now.

Not Reporting Changes: Hired three workers? Tell your insurer. Bought new equipment? Report it fast. Changes affect coverage.

How to Buy Coverage Online

Buying through mywebinsurance.com business insurance takes six steps.

Collect Your Info: Get your tax ID. Know your revenue. Count your workers. List your equipment.

Fill Out Forms: Type in your business details. Answer the questions. Be honest and complete.

See Your Quotes: Prices appear instantly. Multiple companies show offers. Each quote shows different coverage.

Study Each Option: Read what’s covered. Check the limits. Look at deductibles. Compare side by side.

Get Help If Needed: Questions come up. Call or chat with support. Get clear answers before buying.

Complete Purchase: Pick your policy. Enter payment info. Sign electronically. Coverage starts right away.

Industry-Specific Needs

Your business type changes what you need.

Stores: Customers visit daily. Slips and falls happen. Inventory gets stolen. Focus on liability and property.

Restaurants: Food makes people sick. Alcohol creates problems. Kitchen fires start fast. Get specialized food coverage.

Tech Companies: Client data needs protection. Software errors cause losses. Cyber-attacks happen daily. Professional and cyber coverage matter most.

Builders: Workers get injured often. Tools cost thousands. Projects face lawsuits. High liability limits save you.

Medical Offices: Patient care creates huge risks. One mistake costs millions. Malpractice insurance comes first.

Maintaining Your Coverage

Buying insurance once isn’t enough. You need to manage it.

Check Yearly: Set a calendar reminder. Review your coverage every twelve months. Does it still fit your business?

Report Big Changes: Moved offices? Tell your insurer. Bought expensive equipment? Make a call. Hired twenty workers? Send an update.

Know the Claims Process: Read your policy. Find the claims number. Learn what paperwork they want. Be ready before problems hit.

Build Safety Systems: Train workers properly. Post safety signs. Fix hazards fast. Safe businesses pay less.

Cost-Saving Strategies

Lower your bills without losing protection.

Buy Multiple Policies: Get everything from one company. They discount the total. You save twenty percent or more.

Raise Deductibles: Agree to pay more when claims happen. Your monthly bill drops. Good for businesses with emergency funds.

Add Safety Features: Install alarms. Put up cameras. Create safety rules. Show insurers you prevent problems.

Pay Once Yearly: Monthly payments include fees. Yearly payments skip those fees. Save fifty to one hundred dollars.

Fix Your Credit: Insurers check credit scores. Better scores mean lower rates. Pay bills on time.

Conclusion

Your business needs protection today. Mywebinsurance.com business insurance makes buying simple. Compare prices in minutes. Get coverage from your desk. Review policies every year. Update when your business changes. Accidents happen without warning. Lawsuits arrive unexpectedly. Equipment fails suddenly. Be ready before disaster strikes. Protect what you built.